Supporting a smooth management buyout and long-term growth

When the founder of Newfield Fabrications in Sandbach, Cheshire, prepared to retire, the management team led by Josh Dudley-Toole sought funding to acquire the business and ensure a seamless transition. With a customer base including JCB, Leyland, and DAF, the team required a £4–4.5 million package to cover the acquisition, working capital, and post-sale costs. Able Commercial Finance worked closely with the company’s accountants to structure a blended funding solution combining invoice finance, asset finance, a working capital loan, and R&D tax credits – enabling the acquisition to complete smoothly with the vendor paid in full.

Ongoing partnership and growth

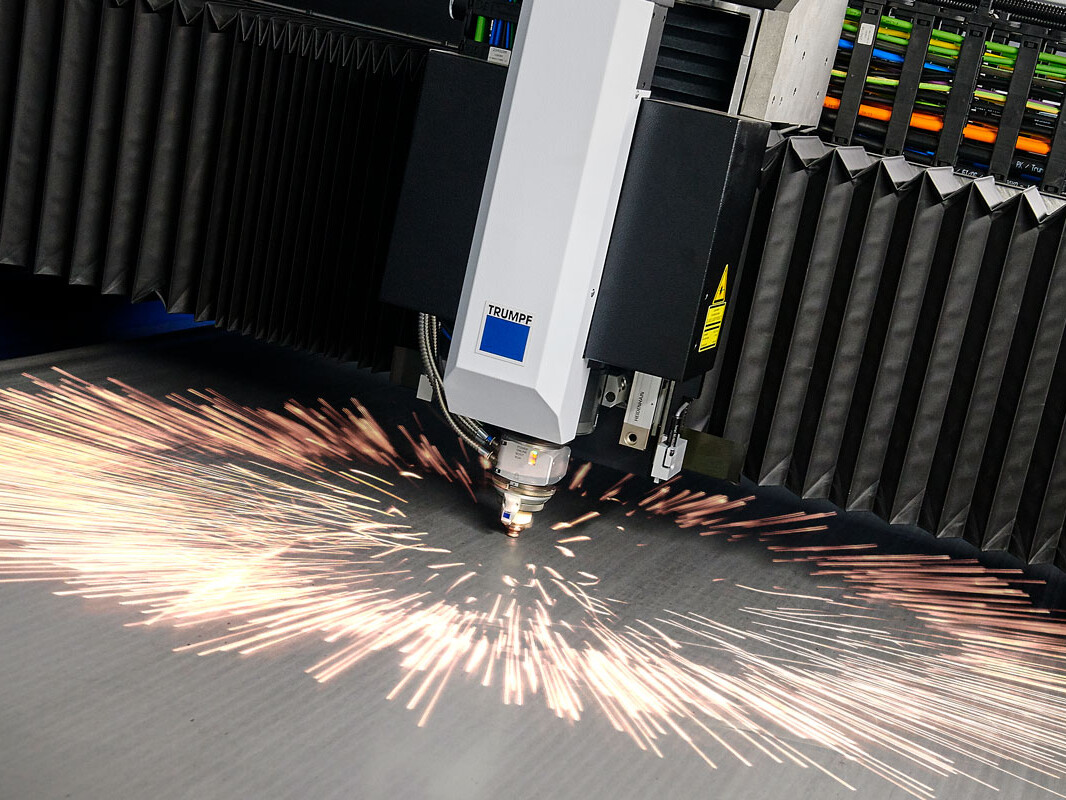

Able’s support didn’t stop there. Since the buyout, Newfield has continued to partner with Able to secure further funding for new machinery, manage cash flow during seasonal dips, and release capital from existing assets. This flexible, long-term approach has helped turnover grow from £8 million to £15 million in just seven years. With a modernised plant and solid financial foundation, Newfield is now well positioned for continued expansion and investment in innovation.